Investing in the financial markets can be intimidating for beginners. This is especially true when faced with market volatility and unpredictable price fluctuations. However, there is a strategy that allows investors to navigate these uncertainties and potentially achieve favorable long-term results: dollar cost averaging. In this article, we will explore the concept of dollar cost averaging versus lump sum investing. We will also uncover their potential benefits and drawbacks.

With this knowledge, we hope to empower you to invest with more confidence!

What is dollar cost averaging?

Dollar cost averaging (DCA) is an investment strategy that involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions. Instead of attempting to time the market and make lump sum investments, investors using DCA spread their investments over time.

Investing a fixed amount each time means investors buy more shares when they are cheap, and fewer shares when they are more expensive.

The mechanics of dollar cost averaging

To grasp how dollar cost averaging works, let’s break it down into three key components:

1. Consistent investments

With DCA, investors commit to making regular investments at predetermined intervals, such as monthly or quarterly. This regularity ensures a disciplined approach to investing, regardless of market ups and downs.

By investing consistently, you take advantage of the fluctuations in market prices over time.

2. Buy more when prices are low

One of the significant advantages of DCA is the ability to purchase more shares when prices are lower.

During market downturns, when prices are cheaper, the fixed investment amount can buy a greater number of shares. This lowers the average cost per share and positions investors to benefit from potential price increases in the future.

3. Smoothing out market fluctuations

DCA helps smooth out the impact of market fluctuations on your investment portfolio. By spreading investments over time, you reduce the risk of making significant investments during market peaks and potential losses during market downturns.

This approach eliminates the need to predict market movements and relieves the stress associated with timing the market accurately.

Unlocking the full potential of dollar cost averaging

To fully harness the power of dollar cost averaging, consider the following strategies:

- Start Early and Stay Consistent

The earlier you start investing, the more time you have to benefit from the power of compounding. Commit to consistent investments, whether it’s monthly, quarterly, or annually, and stick to your investment plan. Regular contributions ensure that you participate in the market’s long-term growth potential. - Automate Your Investments

Set up automatic transfers or investment purchases to ensure that your contributions are consistent and disciplined. Automation prevents missed investment purchases and allows you to stay on track with your DCA strategy, regardless of market conditions or personal circumstances. It is similar to a “pay yourself first” strategy. - Embrace a Long-Term Perspective

Dollar cost averaging is a long-term investment strategy. Avoid reacting to short-term market fluctuations and maintain a focus on your long-term financial goals. Stay committed to your investment plan and resist the urge to make impulsive investment decisions based on short-term market movements. - Diversify Your Portfolio

While DCA helps mitigate the impact of market fluctuations, diversification further reduces risk. Consider spreading your investments across different asset classes, industries, and geographic regions. Diversification helps protect your portfolio from the volatility of individual investments and enhances the potential for long-term growth.

What is lump sum investing?

Lump sum investing refers to the practice of investing a large sum of money in a single transaction. Instead of gradually investing over time, as in dollar cost averaging, lump sum investing involves deploying the entire investment amount at once.

This approach provides immediate exposure to the market and potential returns based on the performance of the investment.

Additionally, lump sum investing requires making a decision on when to invest the money, considering factors such as market conditions, investment goals, and risk tolerance.

Examples comparing dollar cost averaging and lump sum investing

We will look at two examples to compare portfolio values when using lump sum investing and dollar cost averaging strategies.

The first example will demonstrate how lump sum investing and dollar cost averaging compare when the market trends up over a certain period, and the second when the market trends down.

We have $12,000 and decide to invest in an index fund. Lump sum investing involves purchasing the full $12,000 worth of stock. Dollar cost averaging involves investing the $12,000 over one year in twelve equal instalments, equating to $1000 per month.

Note that these examples use randomly generated prices and are not taken from any real-world index fund. They are only representative of prices for the purposes of highlighting the differences between lump sum investing and dollar cost averaging strategies.

Example 1: Market trending up

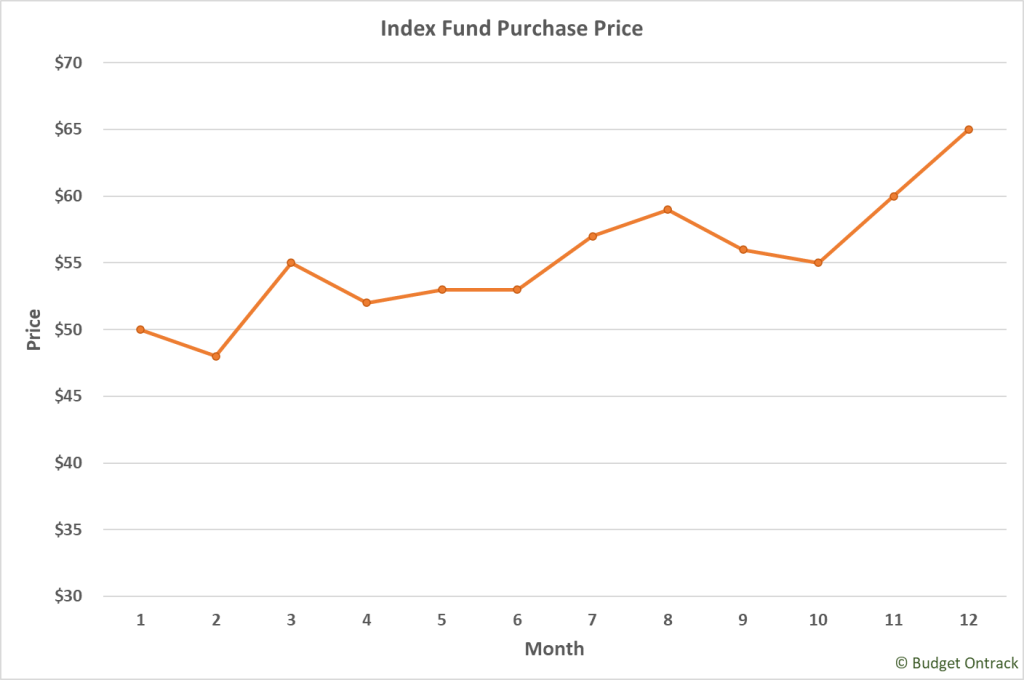

In this example, we will calculate the value of the portfolio when the market is trending up. Chart 1 shows the price of the index fund when the purchases are made (example prices only).

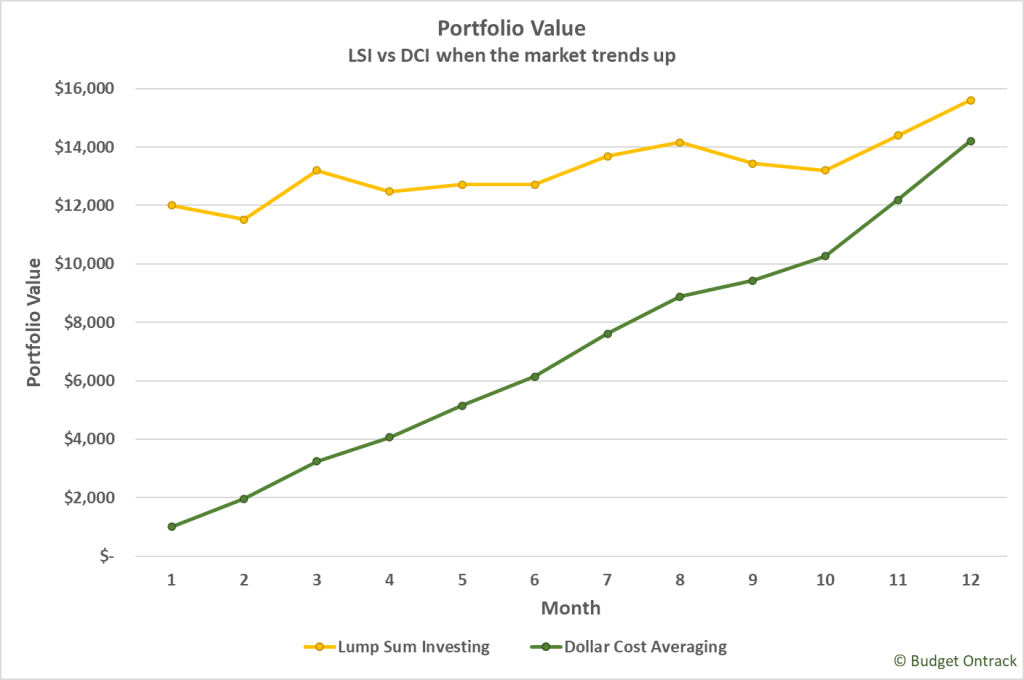

Chart 2 compares the portfolio value over the 12-month period between the lump sum investing and dollar cost averaging strategies.

In this case, lump sum investing has beat dollar cost averaging. When the market trends up, investing the total amount of money at the beginning takes advantage of having your money work for you right from the beginning.

Example 2: Market trending down

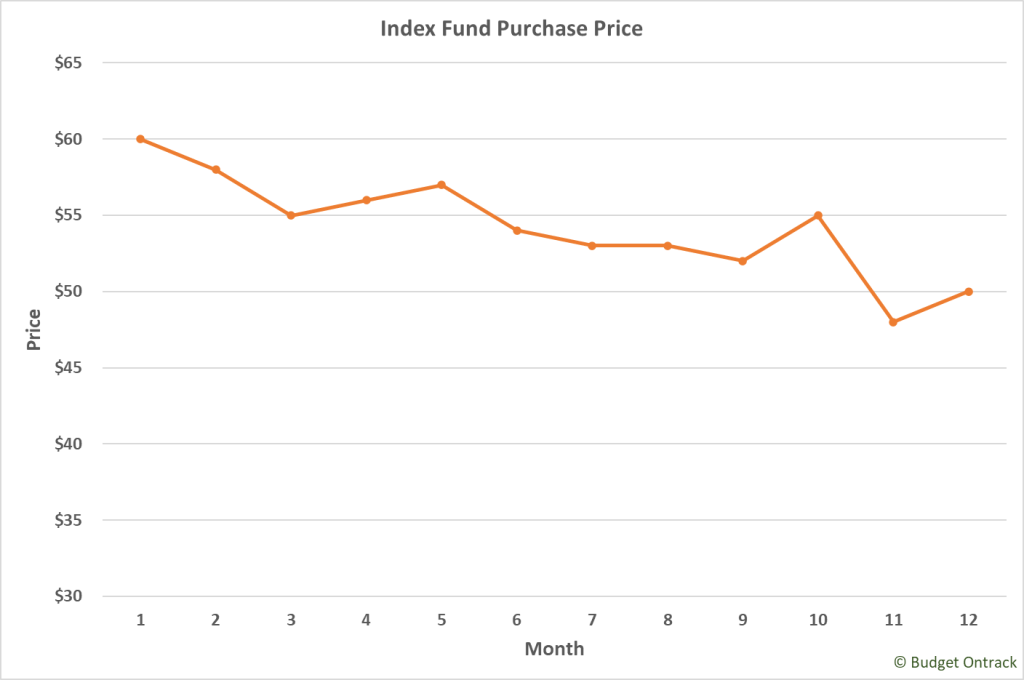

In this example, we will calculate the value of the portfolio when the market is trending down. Chart 3 shows the price of the index fund when the purchases are made (example prices only).

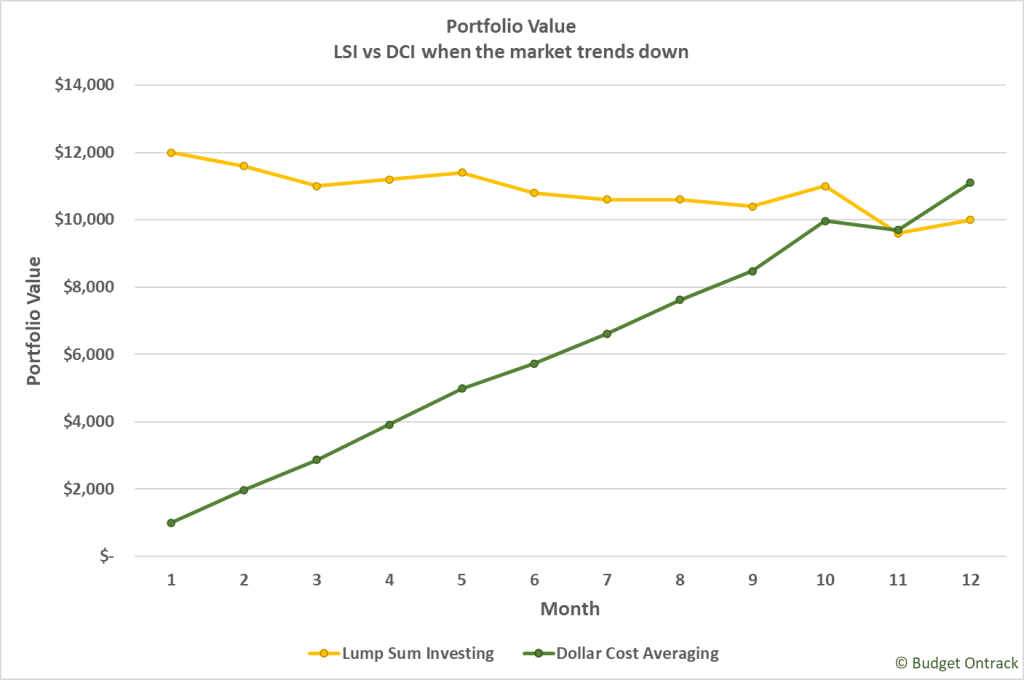

Chart 4 compares the portfolio value over the 12-month period between the lump sum investing and dollar cost averaging strategies.

In the case when the market trends down, dollar cost averaging beats lump sum investing. Market downturns often have a negative emotional effect on investors when they see their lump sum portfolio value declining as shown in Chart 4. The dollar cost averaging investor, on the other hand, will continue to see their investment steadily increasing.

The more experienced investors will realize that, because markets rise over the long run, lump sum investing is the better strategy for maximizing gains. The examples given here demonstrate that this is indeed the case.

However, the psychological impact of investing a lump sum only to learn that the market starts to fall can be enough for investors to sell out, and often at a loss.

So, which is better: dollar cost averaging or lump sum investing?

A common question individuals ask after they receive a money windfall is, “Should I invest all of my windfall at once, or invest a fraction at a time over a longer period?”

Let’s cover some potential advantages and disadvantages to help with this decision.

Advantages of dollar cost averaging

- Risk reduction: Dollar cost averaging spreads your investment over time, reducing the risk of making a large investment at a market peak. It allows you to buy more shares when prices are low and fewer shares when prices are high.

- Emotional discipline: Dollar cost averaging helps remove the emotional element from investing by following a systematic approach. It prevents the temptation to time the market or make impulsive investment decisions.

- Consistent savings: Dollar cost averaging encourages regular investing by contributing a fixed amount at regular intervals, promoting a disciplined savings habit.

- Potential for lower average cost: By buying more shares when prices are low, DCA may result in a lower average cost per share over the long term.

Disadvantages of dollar cost averaging

- Missed opportunity: Dollar cost averaging involves investing smaller amounts over time, which means potentially missing out on substantial gains if the market experiences a significant rally.

- Higher transaction costs: If you’re paying transaction fees or brokerage commissions with each instalment, dollar cost averaging can result in higher overall transaction costs compared to lump sum investing.

- Potential for lower returns: Since dollar cost averaging invests gradually, it may result in lower overall returns compared to lump sum investing if the market consistently trends upward.

Advantages of lump sum investing

- Potential for higher returns: Lump sum investing has the potential to generate higher returns, especially in rising markets, as the entire investment is deployed at once.

- Immediate exposure to the market: By investing a lump sum, you can immediately participate in market growth and potential dividend payouts.

- Lower transaction costs: Lump sum investing typically incurs lower transaction costs since you make a single investment instead of multiple smaller ones.

Disadvantages of lump sum investing

- Market timing risk: Investing a large sum at once exposes you to the risk of market volatility. If the market declines soon after your investment, you could experience significant losses.

- Emotional impact: Lump sum investing can be emotionally challenging, especially during market downturns, as you may feel regret or anxiety if the value of your investment drops significantly.

- Missed opportunity for cost averaging: By not spreading out your investment over time, you may miss the opportunity to buy at lower prices during market downturns.

A useful rule of thumb if you are still undecided

If you are still not sure which strategy is best for you, check out the rule devised by The Money Guy team (link to YouTube video opens in new tab/window). Avoid analysis paralysis and follow these simple steps:

- If the windfall amount is less than 10 % of your current investable assets (*), consider lump sum investing.

- If the windfall amount is 10 % or more of your current investable assets, consider a DCA strategy as follows:

- if the windfall is 10 % of current investable assets, dollar cost average over 5 months.

- for every 5% increase in windfall as a percentage of current investable assets, add 1 month to your dollar cost average timeframe.

- if the windfall is 45% or more of your current investable assets, dollar cost average over 12 months.

(*) Investable assets are the things you own that can be easily liquidated and invested. The money in your bank accounts, stocks, bonds, and mutual funds are examples of investable assets.

For example, if the value of your current investable assets is $120,000, the following table explains which DCA strategy to use based on the windfall amount.

| Windfall Amount | Windfall as % of Current Investable Assets | Dollar Cost Average Strategy |

|---|---|---|

| $6,000 | 5 % | Windfall is less than 10% of current investable assets, so invest as a lump sum instead of DCA. |

| $12,000 | 10 % | DCA over a period of 5 months: $2,400 per month. |

| $30,000 | 25 % | DCA over a period of 5 + 3 = 8 months: $3,750 per month. |

| $60,000 | 50 % | Windfall is 45% or more of current investable assets, so DCA over a period of 12 months: $5,000 per month. |

Final thoughts

Dollar cost averaging empowers investors to navigate market volatility, eliminate the need for perfect market timing, and build wealth over time. By consistently investing fixed amounts at regular intervals, investors can benefit from lower average costs per share and potentially achieve favourable long-term results.

By regularly investing a fixed amount of money and allowing the power of compounding to work, an investor can potentially achieve significant growth in their investment over time, while reducing the impact of volatility on their overall investment.

Whether you are a seasoned investor or just starting your investment journey, dollar cost averaging offers a disciplined approach that instils confidence and minimizes the emotional roller coaster of trying to time the market.

Ultimately, the choice between dollar cost averaging and lump sum investing depends on individual circumstances, risk tolerance, and investment goals. The rule of thumb discussed in this article can help avoid “analysis paralysis” by providing simple steps based on your individual financial situation. As always, it’s important to carefully consider these factors and consult with a financial advisor before making any investment decisions.