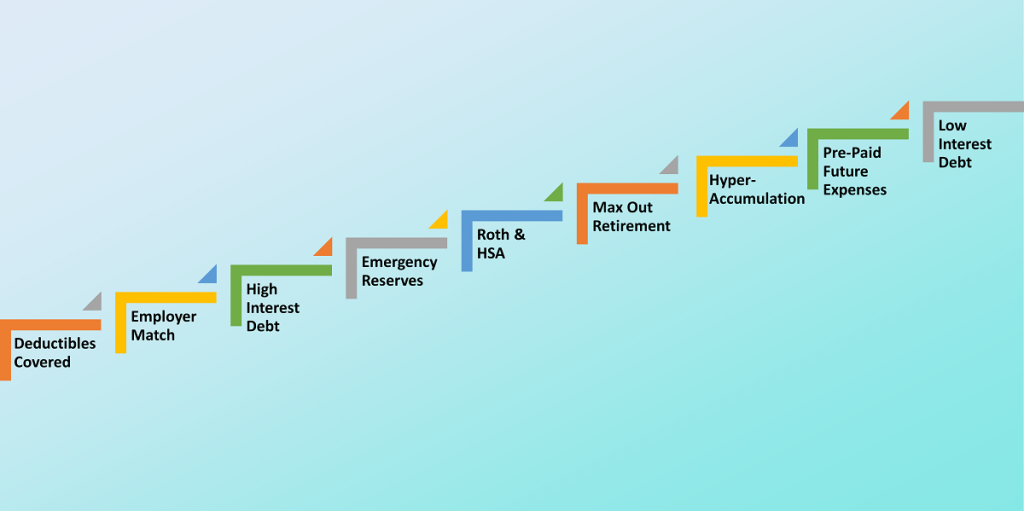

Whether you’re a recent college graduate, a young professional starting your career, or a little older, understanding how to manage your money effectively is a crucial skill set. This article will guide you through the Money Guy’s Financial Order of Operations – a strategic roadmap created by financial experts Brian Preston and Bo Hanson.

The nine steps of the financial order of operations are your keys to achieving financial stability, building wealth, and reaching your financial goals. Whilst they are aimed primarily at the US population, the steps can be adapted and applied elsewhere.

Key Takeaways

- Start with insurance: Establishing adequate insurance to cover deductibles ensures you’re prepared for unexpected expenses without tapping into your savings or going into debt.

- Maximize employer match: Contribute enough to your retirement plan to get the full employer match. This is essentially free money and significantly boosts your retirement savings.

- Pay off high-interest debt: Prioritize eliminating high-interest debt, such as credit card balances, to reduce the financial burden of interest payments and free up money for other financial goals.

- Build emergency reserves: Save 3 to 6 months’ worth of living expenses in an emergency fund to provide a financial safety net for unforeseen events like job loss or medical emergencies.

- Invest in Roth IRAs and HSAs: Contribute to Roth IRAs and Health Savings Accounts for their tax advantages and dual purposes of retirement and healthcare savings.

- Maximize retirement contributions: Max out contributions to retirement accounts like IRAs and 401(k)s early to leverage compound interest for long-term growth.

- Aggressive savings: Engage in hyper-accumulation by saving and investing aggressively beyond minimum retirement requirements to achieve financial independence sooner.

- Pre-paid future expenses: Set aside money for future planned expenses such as college tuition, home upgrades, or vacations to avoid accumulating debt.

- Pay off low-interest debt: After high-interest debt, focus on paying off low-interest debt like mortgages or student loans to simplify finances and reduce obligations.

- Financial mastery roadmap: Following these nine steps provides a structured path toward financial stability, wealth-building, and achieving long-term financial goals.

Whether you dream of home ownership, early retirement, or simply securing your financial future, these nine steps will help you pave the way to financial success. Let’s dive in!

1. Deductibles covered

Think of this like your financial seatbelt. Make sure you have insurance to handle unexpected events.

You wouldn’t want to be involved in a car accident or experience a sudden illness to wipe out your savings, right? Ensure you have adequate insurance to cover such unexpected events.

This step prevents you from dipping into your emergency savings or going into debt when you need to make insurance claims.

2. Employer match

This step is specific to US employees. Imagine your boss offering you free money. That’s what an employer match on your retirement plan is. Contribute enough to get the full match – it’s like getting a bonus for your future.

There are conditions applicable to employer matching. The first is the amount your employer will match, which is often up to 50% of the amount you contribute. The second is that it is capped to a certain percentage of your salary.

Maximizing the match is a smart way to grow your retirement savings. Over time, the employer match can help grow your retirement savings into a substantial nest egg. You’re essentially getting paid to save for your future!

3. Pay down high-interest debt

Start by paying off high-interest debt, like credit card balances. The interest on such debt can be a significant financial burden, so eliminating it should be a priority.

High-interest debt, like credit cards, is like a money-eating monster. Your priority should be to pay it off fast. The less interest you pay, the more money stays in your pocket. allowing you to keep more of your hard-earned money. It’s like giving yourself a raise!

And the great part is, paying down high-interest debt will leave you with more money for the following steps.

4. Emergency reserves

Build an emergency fund with 3 to 6 months’ worth of living expenses. This provides a financial safety net in case of unexpected job loss, medical expenses, or other emergencies.

Having an emergency fund provides peace of mind and financial security. No need to panic when the car breaks down or if you face unexpected medical bills. You’ve got it covered without resorting to high-interest loans or credit cards.

5. Build up Roth and HSA

Contribute to Roth IRAs and Health Savings Accounts (HSAs) if eligible. Both offer tax advantages and can serve as retirement or healthcare savings vehicles.

Think of these accounts as secret vaults for your future. Roth IRAs and HSAs come with tax benefits and can be used for retirement or health expenses.

With a Roth, you can enjoy tax-free withdrawals in retirement. An HSA not only covers medical expenses but can also serve as an additional retirement fund.

6. Max out retirement funds

Maximize contributions to retirement accounts like IRAs and 401(k)s. The more you invest early, the more time your money has to grow through compound interest.

Saving for retirement might seem distant, but it’s like planting a money tree that grows over time. Contribute as much as you can while you’re young – your future self will thank you. The earlier you start, the less you need to save each month to reach your retirement goals.

7. Hyper-accumulation

This step involves saving aggressively, well beyond the minimum required for retirement. It’s about rapidly accumulating wealth, often through investments, to achieve financial independence earlier in life.

This is a faster way of growing your money compared with saving in a bank account. It’s like turbocharging your financial journey. Save aggressively and invest wisely to reach your financial goals faster.

8. Pre-paid future expenses

Set aside money for future expenses such as college tuition, home upgrades, or planned vacations. This helps you avoid going into debt for these costs.

Consider this like setting aside money for fun stuff. It means you won’t have to swipe your credit card and accumulate debt for those cool life experiences. Plus, you’ll have more financial flexibility to seize opportunities as they arise.

9. Pay off low-interest debt

After addressing high-interest debt, you can focus on paying off low-interest debt like a mortgage or student loans. These debts may have tax advantages or low interest rates, making them less urgent to pay off.

Paying off low interest debt will free up more money for other goals. You’ll be simplifying your financial life and reducing future obligations. With fewer financial commitments, you’ll have more control over your money and can direct it toward your priorities.

Final thoughts

Following the nine steps of The Money Guy’s Financial Order of Operations provides a comprehensive financial roadmap. It ensures you have a solid financial foundation, are prepared for emergencies, and are making the most of investment opportunities. The goal is to gradually reduce financial stress, grow wealth, and achieve long-term financial security. Keep in mind that everyone’s situation is unique, so it’s essential to tailor this framework to your specific circumstances and financial goals.

FAQs

1. What is the purpose of the Money Guy’s Financial Order of Operations?

The Money Guy’s Financial Order of Operations is a strategic roadmap designed to guide individuals toward financial stability, wealth-building, and achieving financial goals. It outlines nine steps that prioritize actions like saving for emergencies, maximizing retirement contributions, and paying down debt in a logical and effective sequence.

2. Why is having emergency reserves a top priority?

Having emergency reserves is crucial because it provides a financial safety net for unexpected events such as job loss, medical emergencies, or major repairs. This prevents the need to dip into long-term savings or go into debt to cover these unexpected costs, ensuring financial stability.

3. How does employer match work and why should I take advantage of it?

Employer match is when your employer matches your contributions to a retirement plan, such as a 401(k), up to a certain percentage of the amount you contribute and capped at a certain percentage of your salary. Taking advantage of the full employer match is important because it’s essentially free money added to your retirement savings, significantly boosting your future financial security. This matching is an incentive for employees to save for their future and is a key part of retirement planning in the US.

4. Why is it important to pay off high-interest debt first?

Paying off high-interest debt, like credit card balances, is important because the interest on such debt can quickly accumulate and become a significant financial burden. Eliminating this debt frees up more of your income for savings and investments, allowing you to build wealth more effectively.

5. What are Roth IRAs and HSAs, and why should I contribute to them?

Roth IRAs are retirement accounts that allow for tax-free withdrawals in retirement, while Health Savings Accounts (HSAs) offer tax advantages for medical expenses and can also serve as additional retirement funds. Contributing to these accounts provides tax benefits and enhances your financial security for both retirement and healthcare costs.

6. What does hyper-accumulation mean in the context of this financial plan?

Hyper-accumulation refers to saving and investing aggressively beyond the minimum required for retirement. This step focuses on rapidly building wealth, often through strategic investments, to achieve financial independence earlier in life. It accelerates your financial growth and helps you reach your long-term goals faster.

7. Why should I set aside money for future expenses like college or vacations?

Setting aside money for future expenses helps you avoid going into debt for planned costs like college tuition, home upgrades, or vacations. This proactive approach ensures you have the funds available when needed and provides more financial flexibility, allowing you to enjoy life without financial stress.